A Guide To 12 Tips And Tricks While Using Online Banking

People are living on a digitally advanced planet where everything is possible to do on several online platforms. From shopping to food ordering, everything is now possible digitally. Banking tasks also have been shifted to digital platforms. Everything is possible on various online banking platforms, from cash deposits to cash transfers.

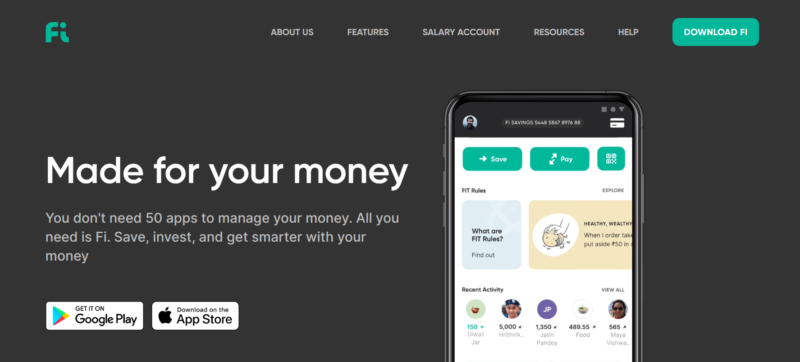

Almost every bank and financial institution has created online apps to offer a significant and convenient way to help users to make payment online. Banks’ online presence has made the whole task easy, saving a lot of time. But there are always positive benefits with negative traits. Online banking attracts hackers sometimes. Previously, some fraudulent activities also have been tracked. So, you need to be very cautious while using online platforms.

Banks and financial institutions are giving helpful suggestions to make your online banking journey easy and safe. You can even choose online investment through those applications. Here in this article, you can find a few tips and tricks to help you experience a seamless online banking journey.

12 Tips and tricks you must follow while using online banking facilities

- Frequently change password

You should change your banking passwords frequently. You should change it at least after every 6 months. Always keep the password private.

- Strong passwords choice

Always create a very strong password. Your banking password must include alpha-numerical characters. Also, include upper and lower cases for the alphabet.

- Do not share credentials

Never ever share any banking credentials with any third-party platforms or any other people. Remember, no bank will ask you about the banking details.

- Keep tracking your account

Always keep an eye on your account bank daily. With a track, you can easily track what is happening in your account.

- Make use of the best authentic software

When using banking software, make sure the mobile app or software is authentic and mentioned by the bank. Also, the updated software should include a licensed antivirus to provide you with the best security.

- Type the website on your own

For online transactions, it is always recommended to type the bank’s URL into the browser’s address bar rather than clicking any links. Once you are on your bank’s online banking page, see if the URL begins with “https.” The prefix denotes secure and encrypted communication between the browser and the website. Authentic websites use this prefix mandatorily. So, if the link is authentic, it will use “https”.

- Disconnect the system while not in use

You may not switch off the connection when you do not use your laptops or personal computers. This can be an opportunity for hackers. Malicious hackers can access your computer through an internet connection and easily check and steal your private banking information. Disconnect from the internet whenever you are not using it to protect your data. It is a mandatory task to do.

- Avoid spam e-mails or phishing emails

One of the most common types of online banking fraud today is phishing. You receive a fraudulent email that purports to be from your bank or other well-known websites. Most of these emails contain a link you are expected to click on. You will be taken to a page where you must enter your banking information after clicking the link.

Be aware that no bank will ever ask for your banking information via email. If you open such emails, you could easily fall victim to a phishing scam.

- Turn on notifications

Customers can receive text and email alerts from the majority of banks for a variety of reasons. It includes receiving a notification when a transaction exceeds a certain threshold when your balance falls below a certain level, and more. Use these notifications to notify you whenever someone tries to access your bank account. Keep your bank’s assistance numbers on hand if you discover a transaction you did not start and need to stop immediately.

- Log out after every use

Do not keep logged in to the app or banking websites. If your banking session logs in constantly, you may face web hijackings. You can also use private or incognito sites to use your banking websites. It can work as another level of security layer.

- Updated software frequently

Ensure you are using the latest operating system on your pc or laptop. The latest version of operating systems is a safe way to use any such websites because they are equipped with various safety measures. They can also fix various bugs. So, update your operating system from time to time.

- Official apps or websites provided by banks

On online sites, you can find various duplicate banking websites prone to hacking or other malfunctioning activities. If you download or use those sites or any online payment app to do all banking work, it may hack your account, and you may lose your hard-earned money. So, using the official site or apps provided by your bank is always recommended. Bank’s original app will be encrypted to provide ultimate security for your banking tasks.

So, here are all 12 major tips that can keep your banking journey safe and secure without any issues. You can easily browse all banking tasks on online platforms like a payment online app.